Imagine looking in the mirror and seeing a reflection that truly embodies health, comfort, and confidence. For many, this dream can become a reality through a process called Full Mouth Reconstruction (FMR). But as exciting as the prospect of a restored smile is, the financial aspect often brings a wave of questions: “How much does it cost?”, “Will my insurance cover it?”, “How can I possibly afford such extensive care?” You’re not alone in these concerns. The financial burden of comprehensive dental care, especially something as extensive as Full Mouth Reconstruction, is a significant barrier for many.

That’s why we’re here to unravel the complexity, offer clear guidance, and show you how making comprehensive care achievable is more within reach than you might think, especially for Markham residents.

The Promise of a New Smile: Understanding Full Mouth Reconstruction (FMR)

Full Mouth Reconstruction isn’t just a dental procedure; it’s a transformative journey. It’s a highly individualized treatment plan designed to rebuild or restore nearly every tooth in your upper and lower jaws.

Think of it as a complete oral overhaul, addressing multiple complex dental issues simultaneously.

When is FMR needed? Often, it’s recommended when you’re facing severe challenges like:

- Extensive tooth decay or erosion

- Multiple missing teeth

- Worn-down teeth due to grinding (bruxism) or acid erosion

- Severe gum disease impacting tooth stability

- Jaw pain and bite problems (TMJ disorders)

- Dental injuries or trauma

The procedures involved can vary greatly but often include a combination of [dental implants], [crowns and bridges], veneers, [periodontal (gum) therapy], [root canals], [extractions (including wisdom tooth removal)], and even [orthodontic treatment like Invisalign] to correct bite issues.

FMR is a significant investment because of its complexity, the specialized skills of multiple dental professionals (like prosthodontists, oral surgeons, and periodontists), and the advanced materials used to ensure long-lasting, natural-looking results.

It’s about restoring not just your teeth, but your ability to chew comfortably, speak clearly, and smile with genuine self-assurance, profoundly impacting your overall quality of life.

Decoding the Costs: A Transparent Look at FMR Expenses

Let’s address the elephant in the room: the cost. It’s natural to feel a bit of sticker shock when considering full mouth reconstruction, as it represents a substantial investment in your health.

However, understanding why it costs what it does, and what influences the price, can help set realistic expectations.

In Canada, and specifically in Markham and throughout Ontario, the average cost for full mouth reconstruction can range significantly, typically from $20,000 to $80,000 or more.

This wide range underscores the highly customized nature of FMR.

What factors influence the final cost?

- The Type and Number of Procedures: Are you primarily replacing missing teeth with

[dental implants]and crowns, or does your plan also include extensive[gum therapy],[root canals], or bone grafting? Each component adds to the overall cost. - Materials Used: The choice of materials for crowns, veneers, or bridges (e.g., porcelain, zirconia, or a combination) impacts both the aesthetics and durability, and therefore the price.

- Dentist’s Expertise and Specialist Fees: FMR often requires the collaboration of several dental specialists. Their advanced training and experience contribute to the quality and success of your treatment.

- Clinic Location: While Markham dental practices strive for competitive pricing, slight variations can exist based on overhead and regional factors.

- Lab Fees: Custom-made prosthetics like crowns and bridges are crafted by specialized dental laboratories, and these precision components contribute to the total expense.

- Anesthesia and Sedation: Options like

[nitrous oxide sedation]or IV sedation can enhance patient comfort during longer procedures, adding to the cost.

Knowing these factors allows for a transparent discussion with your dental team about your treatment plan and its associated costs.

While we don’t have an interactive cost estimator here, a personalized consultation is the best way to get a tailored estimate for your specific FMR needs.

Navigating the Insurance Maze: Maximizing Your Coverage

One of the biggest misconceptions about full mouth reconstruction is that it’s purely cosmetic and therefore not covered by insurance.

While aesthetic improvements are a wonderful outcome, FMR’s primary goal is often to restore function and oral health, which can qualify for significant insurance coverage.

Private Dental Insurance 101

Most private dental insurance plans follow a structure that includes deductibles (what you pay before coverage begins), co-pays (your percentage share of the cost), and annual maximums (the total amount your insurer will pay in a year, typically ranging from $1,000 to $2,500).

Many plans also have waiting periods for major procedures.

- Covered vs. Not Covered: Generally, restorative procedures like

[crowns],[fillings], and[root canals]are covered, often at 50-80%. Truly cosmetic procedures (e.g., veneers for purely aesthetic reasons) are usually not. FMR, by definition, combines both, making the “medical necessity” aspect crucial. - Pre-authorization: For extensive treatments like FMR, always submit for pre-authorization. This is when your dentist sends your treatment plan to your insurer for review before beginning treatment, giving you an estimate of what they’ll cover. It helps avoid unexpected bills.

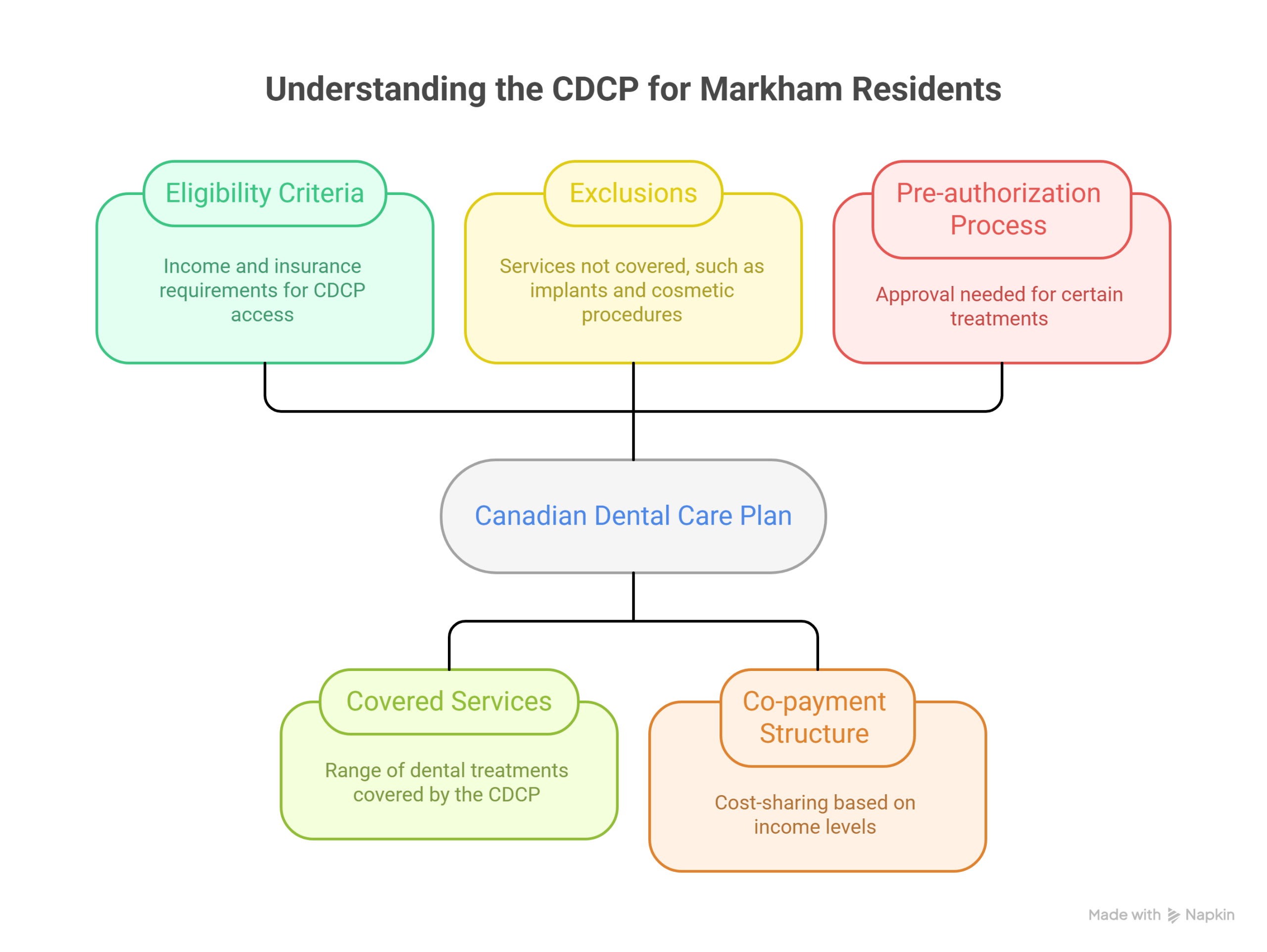

The Canadian Dental Care Plan (CDCP) for Markham Residents: A Closer Look

The newly introduced Canadian Dental Care Plan (CDCP) is a significant development, aiming to make dental care more accessible for eligible Canadian residents, including those in Markham.

However, it’s vital to understand how it applies to comprehensive treatments like FMR.

- Eligibility for Markham Residents: The CDCP is income-based, targeting residents with an adjusted family net income of less than $90,000 who do not have access to private dental insurance.

- What FMR components the CDCP does cover: (Based on

canada.ca) - Diagnostic Services: Exams,

[X-rays]. - Preventive Services:

[Cleanings], fluoride treatments. - Restorative Services:

[Fillings],[root canals], and some types of crowns and[dentures](with specific frequency limits and often requiring pre-authorization). - CRITICAL: What the CDCP DOES NOT cover (Exclusions for FMR):

- Dental implants and all implant-related procedures: This is a major point. The CDCP explicitly excludes implants, bone grafts, and surgical guides. If your FMR plan involves implants, you’ll need alternative financing for these components.

- Fixed bridges: Often, extensive fixed prosthodontics (like fixed bridges over multiple teeth) are also excluded or have very limited coverage under the CDCP.

- Extensive rehabilitation primarily for cosmetic purposes.

- Co-payment Structure: Your out-of-pocket share (co-payment) under the CDCP is based on your adjusted family net income.

- Pre-authorization Process: For many services, especially extensive ones, pre-authorization is mandatory with the CDCP.

Understanding these details is key. While the CDCP can support various fundamental elements of FMR, it’s crucial to plan for the excluded high-cost items like implants.

Imagine a [CDCP Eligibility & Coverage Flowchart] that guides you through what’s covered for your FMR based on your situation.

Leveraging Medical Insurance: When it Might Help

In rare circumstances, your medical insurance might cover specific components of FMR if it’s deemed medically necessary due to an underlying health condition.

This could be the case if your oral health issues are directly related to:

- Severe trauma (e.g., from an accident)

- Treatment for certain diseases (e.g., cancer treatment that severely damaged oral structures)

- Systemic conditions with direct oral manifestations

Working with your dental team to thoroughly document the medical necessity of your FMR can sometimes open doors to medical insurance coverage for specific parts of the treatment.

Strategies to Maximize Benefits

Navigating insurance can feel like a puzzle, but with the right strategy, you can maximize your coverage:

- Always Pre-authorize: For any significant FMR component, submitting a pre-authorization is your best first step.

- Understand Annual Maximums: If your FMR can be phased over two calendar years, you might be able to utilize two annual maximums from your private insurance, spreading the financial load.

- Bundle Procedures Strategically: Discuss with your dentist how different procedures might be categorized for insurance to optimize benefits.

- Don’t Fear Appeals: If a claim is denied, don’t give up immediately. Work with your dental office to review the denial reason and prepare a robust appeal with detailed clinical notes, X-rays, and a letter of medical necessity. We could provide a

[Printable Checklist: Questions for your Insurance Provider]to guide these discussions.

Exploring Financing Options: Making FMR Affordable

Even with insurance, a financial gap often remains for full mouth reconstruction.

The good news is that there are many financing solutions available to make this comprehensive care achievable.

Dedicated Dental/Medical Credit Cards (e.g., CareCredit)

These are credit cards specifically designed for healthcare expenses.

They often offer promotional periods with 0% APR (Annual Percentage Rate) if the balance is paid within a set timeframe (e.g., 6, 12, or 18 months).

- Pros: Quick approval, specific for healthcare costs, can be interest-free if paid on time.

- Cons: Very high interest rates can apply if the balance isn’t paid off by the end of the promotional period, impacting your credit score.

Personal Loans

You can apply for personal loans from banks, credit unions, or online lenders.

Canadian companies like iFinance Canada (which offers Dentalcard) provide loans specifically for dental procedures.

- Pros: Fixed interest rates, predictable monthly payments, longer repayment terms (1-7 years).

- Cons: Interest starts accruing immediately, approval depends on your credit score, can require collateral for larger amounts.

In-House Payment Plans

Many dental clinics, including Bur Oak Dental, understand the financial challenges of FMR and offer their own [in-house payment plans].

- Pros: Often interest-free for shorter terms, flexible arrangements directly with your trusted clinic, can build a strong patient-provider relationship.

- Cons: Typically for smaller balances or shorter repayment periods, may require a down payment.

Health Savings Accounts (HSAs) & Flexible Spending Accounts (FSAs)

While more common in the US, some Canadians with specific employer benefit plans or self-employed individuals may have access to similar tax-advantaged accounts.

These allow you to set aside pre-tax dollars for healthcare expenses.

- Pros: Tax benefits, funds dedicated to health.

- Cons: “Use it or lose it” rules for FSAs, contribution limits.

Other Avenues

- Retirement Plan Loans: Borrowing from your RRSP or other retirement funds can offer lower interest rates, but comes with significant risks like tax implications if not repaid, and potential early withdrawal penalties.

- Home Equity Loans: Leveraging your home’s equity can provide large sums at lower interest rates, but it puts your home at risk if you default on payments. Exercise extreme caution with this option.

Imagine having a [Financing Comparison Matrix] that visually breaks down the APR, terms, and pros/cons of each option to help you make an informed decision.

For more personalized guidance on financing, we offer [free consultations] to discuss your options.

Your FMR Financial Roadmap: Combining Strategies for Markham Residents

The true “aha moment” often comes when you realize you don’t have to rely on a single financial solution.

The most effective approach to affording full mouth reconstruction is often a hybrid strategy, combining private insurance, the CDCP, and financing options.

Let’s consider a common scenario for a Markham resident needing FMR, including several dental implants, [crowns], and [gum therapy]:

- Private Insurance First: Your private dental insurance plan covers 80% of your

[periodontal (gum) therapy]and 50% of your[crowns], up to your annual maximum. You strategically plan some procedures to utilize two annual maximums. - CDCP Support: For eligible services, the CDCP steps in. It covers your initial diagnostic

[X-rays]and could contribute to eligible[crowns]or even[dentures]if they’re part of your plan and your private insurance limits are met. Crucially, the CDCP will not cover your dental implants or related bone grafts. - Bridging the Gap with Financing: The remaining out-of-pocket costs for your implants and any remaining portions of crowns (after private insurance and CDCP) can be covered by a personal loan (like a Dentalcard from iFinance Canada) or an in-house payment plan from Bur Oak Dental.

This multi-pronged approach breaks down a large, intimidating cost into manageable segments.

Scenario-Based Guidance:

- “I have private insurance + CDCP”: Maximize private insurance benefits first, then leverage the CDCP for eligible (non-implant) components, and use financing for the rest.

- “I only have CDCP”: Focus on maximizing CDCP benefits for covered essentials, then explore personal loans or in-house payment plans for procedures like implants and extensive fixed prosthodontics not covered.

- “I have no insurance”: In-house payment plans and personal loans become your primary tools. Focus on the long-term health benefits of the investment.

You could envision a [Step-by-Step Decision Tree] that visually guides you through the optimal financial pathway based on your unique situation.

Questions to Ask Your Dentist & Insurance Provider:

To empower you in these discussions, here’s a comprehensive list of questions to consider:

- “What exact procedure codes will be used for each component of my FMR plan?”

- “Can we pre-authorize all steps of my treatment plan with both my private insurer and the CDCP?”

- “What are the estimated costs for each individual procedure, and what materials are being used?”

- “What are your in-house payment plan options, terms, and interest rates (if any)?”

- “Do you work with any third-party financing companies you recommend?”

- “How can we best document the medical necessity of my FMR for insurance purposes?”

- “Can you help me understand how to phase my treatment to utilize my annual insurance maximums effectively?”

By asking these questions, you become an informed advocate for your own oral health journey.

Full mouth reconstruction is a significant investment, but it’s an investment in a lifetime of better health, comfort, and confidence.

The lifespan of FMR components can be 10-15 years or more with proper care, making the initial financial planning a worthwhile endeavor. [Discover Our Dental Implant Solutions]

Frequently Asked Questions (FAQ) about FMR Financing & Insurance

Q1: Is full mouth reconstruction considered cosmetic or medically necessary?

It depends on the individual case. While FMR can significantly improve aesthetics, it’s primarily performed to restore function, health, and comfort. Procedures to address severe decay, gum disease, missing teeth, or bite issues are often considered medically necessary. This distinction is crucial for insurance coverage.

Q2: How much does full mouth reconstruction typically cost in Markham, Ontario?

Costs can vary widely depending on the complexity, the number of procedures, materials used, and the dental professional’s fees. In Markham and throughout Ontario, FMR can range from approximately $20,000 to $80,000 or more. A personalized consultation is essential for an accurate estimate.

Q3: Does the Canadian Dental Care Plan (CDCP) cover full mouth reconstruction?

The CDCP covers some components of FMR for eligible individuals, such as diagnostic services, fillings, root canals, and certain crowns or dentures. However, it explicitly excludes significant procedures like dental implants, bone grafts, and most fixed bridges, which are often integral to extensive full mouth reconstruction. Understanding these exclusions is key to planning.

Q4: Can I use both my private dental insurance and the CDCP for FMR?

Yes, for different components. Your private insurance might cover a percentage of certain restorative procedures, up to your annual maximum. The CDCP can then be leveraged for other eligible services, keeping in mind its specific exclusions for implants and fixed prosthodontics. Developing a combined strategy with your dental team is recommended.

Q5: What are common financing options available for FMR?

Common options include dedicated dental credit cards (often with promotional 0% interest periods), personal loans from banks or credit unions (like those offered by iFinance Canada), and in-house payment plans directly through your dental clinic. Some individuals also consider using Health Savings Accounts (HSAs) or home equity loans, though these come with specific considerations.

Q6: How can I appeal an insurance denial for FMR procedures?

If your FMR claim is denied, carefully review the reason provided by your insurer. Work with your dental team to gather comprehensive documentation, including detailed x-rays, photos, and a letter of medical necessity from your dentist explaining why the treatment is essential for your oral health and function. Sometimes, a peer-to-peer review can also be requested.

Q7: Are there any local Markham resources to help with FMR costs?

Beyond private insurance, the CDCP, and national financing solutions, local dental practices like Bur Oak Dental often offer in-house payment plans or [free consultations] to discuss your financial options. It’s always a good idea to inquire directly with your local clinic about their specific offerings and any partnerships they may have.

Next Steps for Markham Residents: Your Path to a Healthier Smile

Embarking on a full mouth reconstruction journey is a significant decision, both for your health and your finances. We hope this guide has demystified the process, providing clarity on the costs, insurance intricacies, and diverse financing avenues available to make this comprehensive care accessible to you.

At Bur Oak Dental, we believe everyone deserves a healthy, confident smile. Our team across our three convenient Markham locations—Bur Oak Dental West, Central, and East—is here to walk you through every step, from understanding your treatment needs to navigating your financial options with transparency and compassion. We offer [Free Consultations for your Full Mouth Reconstruction] to discuss your unique situation and help you build a personalized financial roadmap.

Your “aha moment” might be realizing that FMR isn’t an insurmountable financial barrier, but a planned investment in your long-term health and well-being. Let us help you take that first step.